Looking for professional crypto trading signals that actually work? CryptoLens provides institutional-grade algorithmic trading software with advanced smart money concepts analysis used by professional traders worldwide.

Our automated trading software simplifies complex market analysis, helping you identify high-probability order block trading opportunities in real-time with precision accuracy.

Experience the power of institutional trading patterns and market structure trading strategies that give you the edge in competitive cryptocurrency markets.

Professional Trading Platform Features

Whether you're learning smart money concepts or are a professional trader seeking institutional tools, CryptoLens delivers comprehensive crypto trading analysis with real-time algorithmic trading software capabilities. Our platform specializes in detecting sophisticated order block trading patterns and market structure formations across multiple timeframes. With advanced automated trading software features, multi-timeframe confirmation systems, and professional risk management tools, you maintain a competitive advantage in fast-moving cryptocurrency markets. Join our community of successful traders who leverage SMC trading strategy principles to achieve consistent trading performance using professional institutional trading patterns!

Smart Money Concepts detection with institutional order flow analysis

Order Block Trading identification for precise entry points

Market Structure Trading with breakout and reversal detection

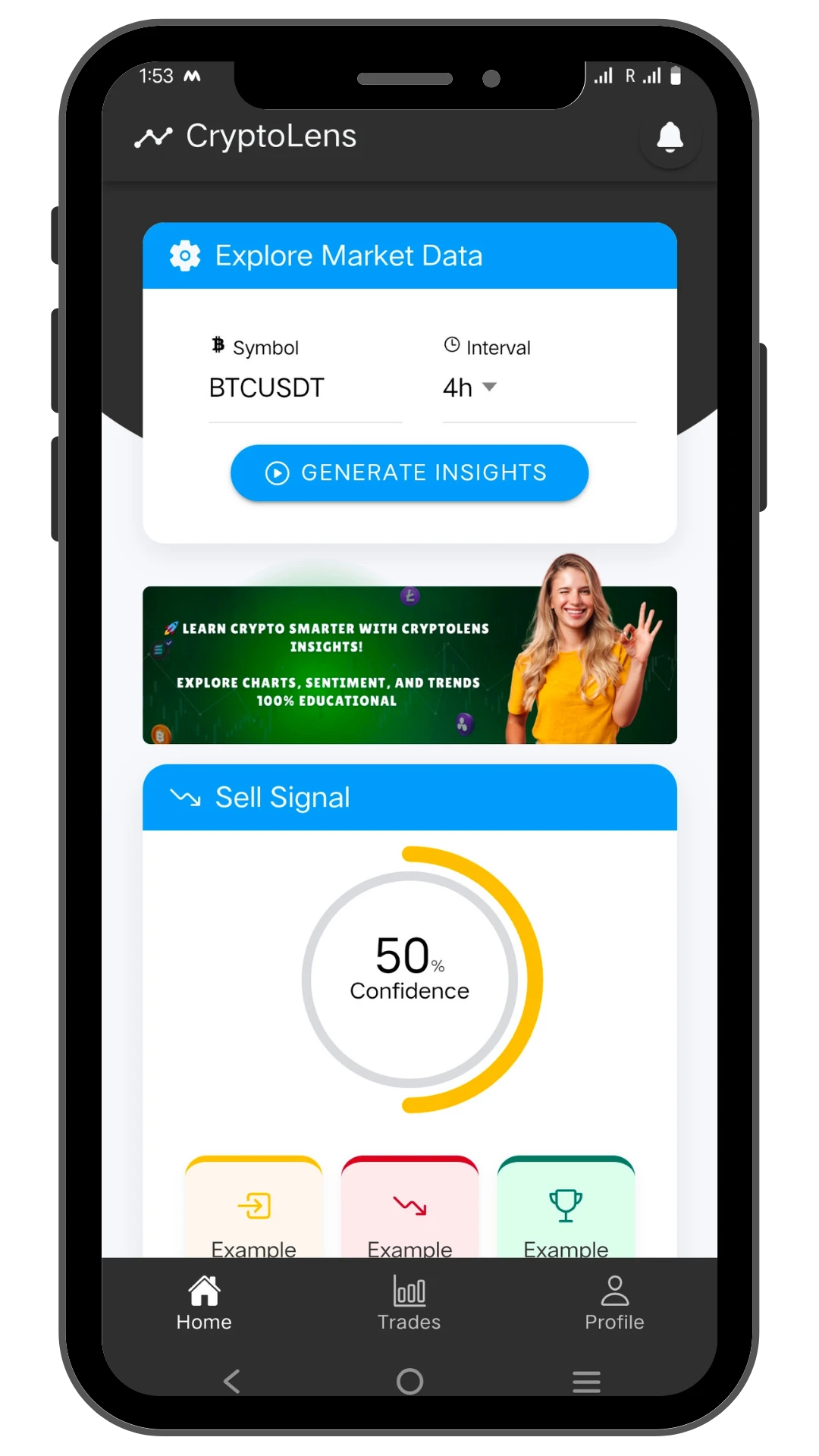

Real-time crypto trading signals with push notifications

Advanced risk management and position sizing tools

Multi-timeframe analysis for institutional trading patterns

CryptoLens: Advanced Algorithmic Trading Software Platform

CryptoLens represents the next generation of algorithmic trading software, specifically engineered for cryptocurrency traders who demand institutional-grade analysis tools. Our platform integrates sophisticated smart money concepts methodology with real-time institutional trading patterns detection, providing you with unparalleled market insights.

Unlike basic trading applications that rely on simple technical indicators, CryptoLens employs advanced market structure analysis and professional order block trading algorithms to identify high-probability trading opportunities with precision timing. Our automated trading software continuously monitors multiple cryptocurrency pairs across various timeframes, ensuring you never miss a profitable setup.

The foundation of CryptoLens is built upon understanding how large financial institutions and professional traders move markets. By analyzing institutional trading patterns and smart money concepts, our platform helps retail traders level the playing field against well-funded professional traders and market makers.

Professional Trading Feature Set

- Smart Money Concepts Analysis: Advanced detection of institutional order flow, market manipulation patterns, and accumulation/distribution zones used by professional traders in live markets

- Order Block Trading System: Precise identification of key supply and demand zones for optimal entry and exit points with minimal risk exposure using professional trading methodologies

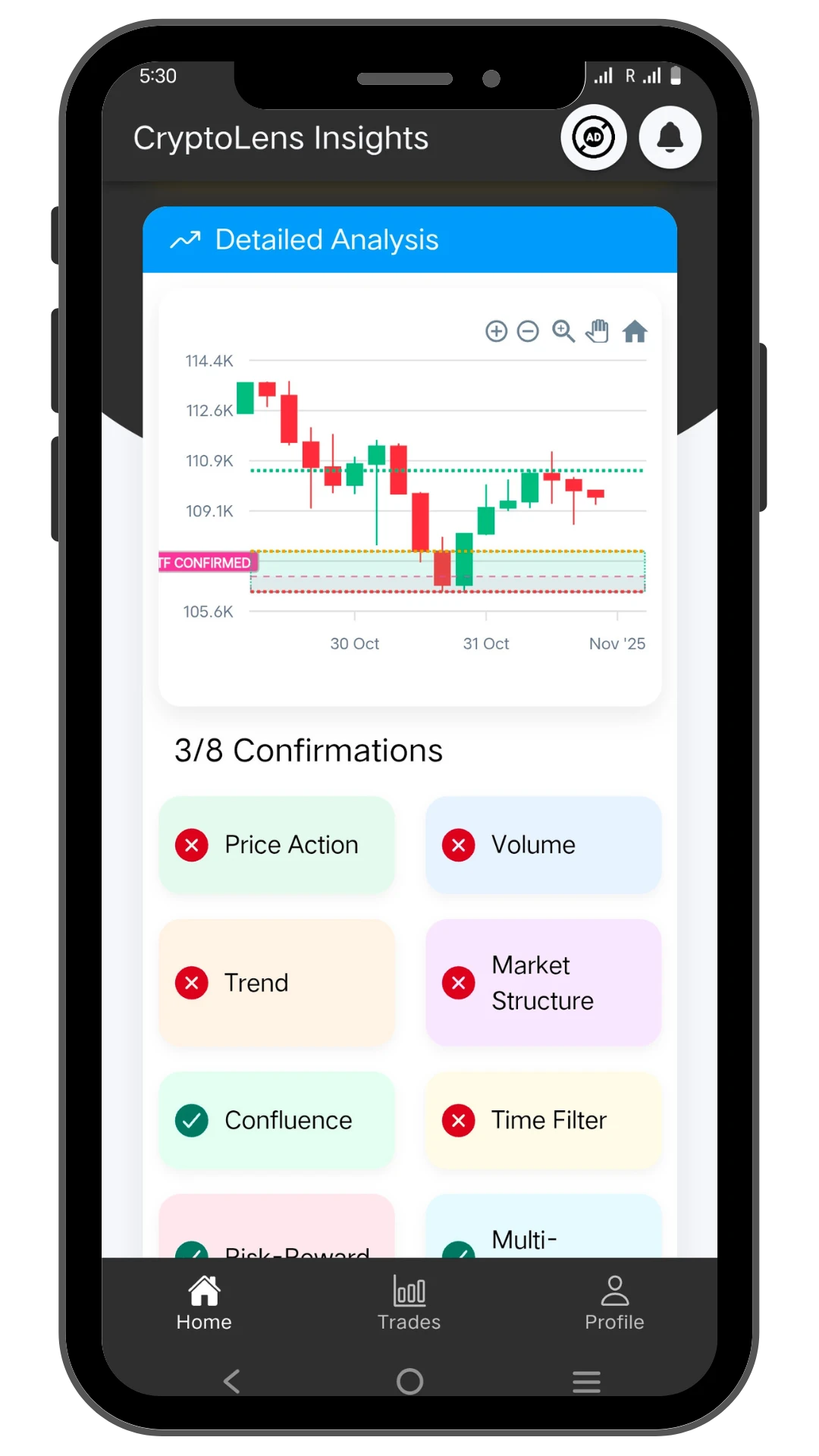

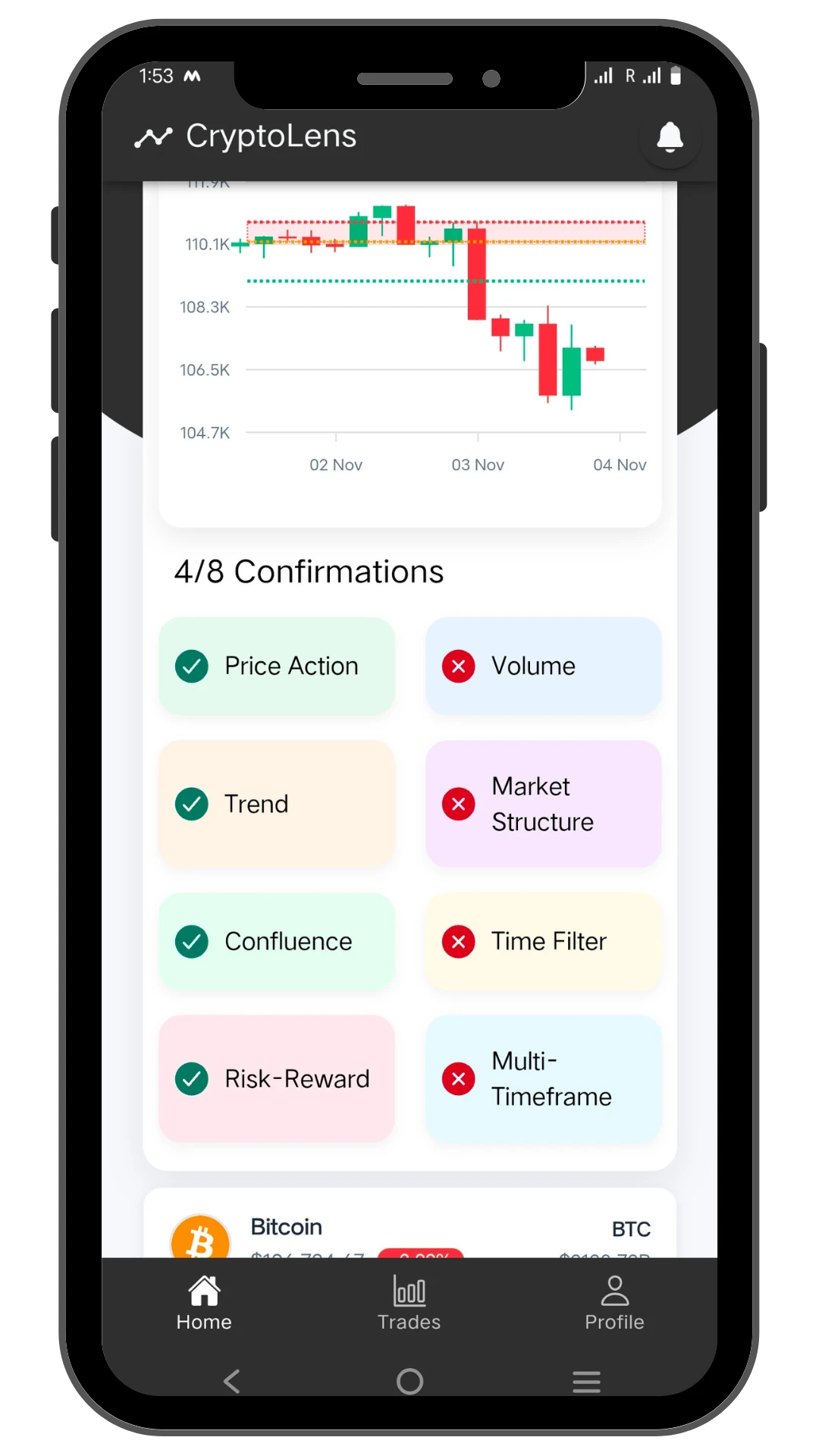

- Multi-timeframe Confirmation Engine: Professional-grade validation of trading signals across multiple timeframes to significantly increase accuracy and reduce false signals in volatile markets

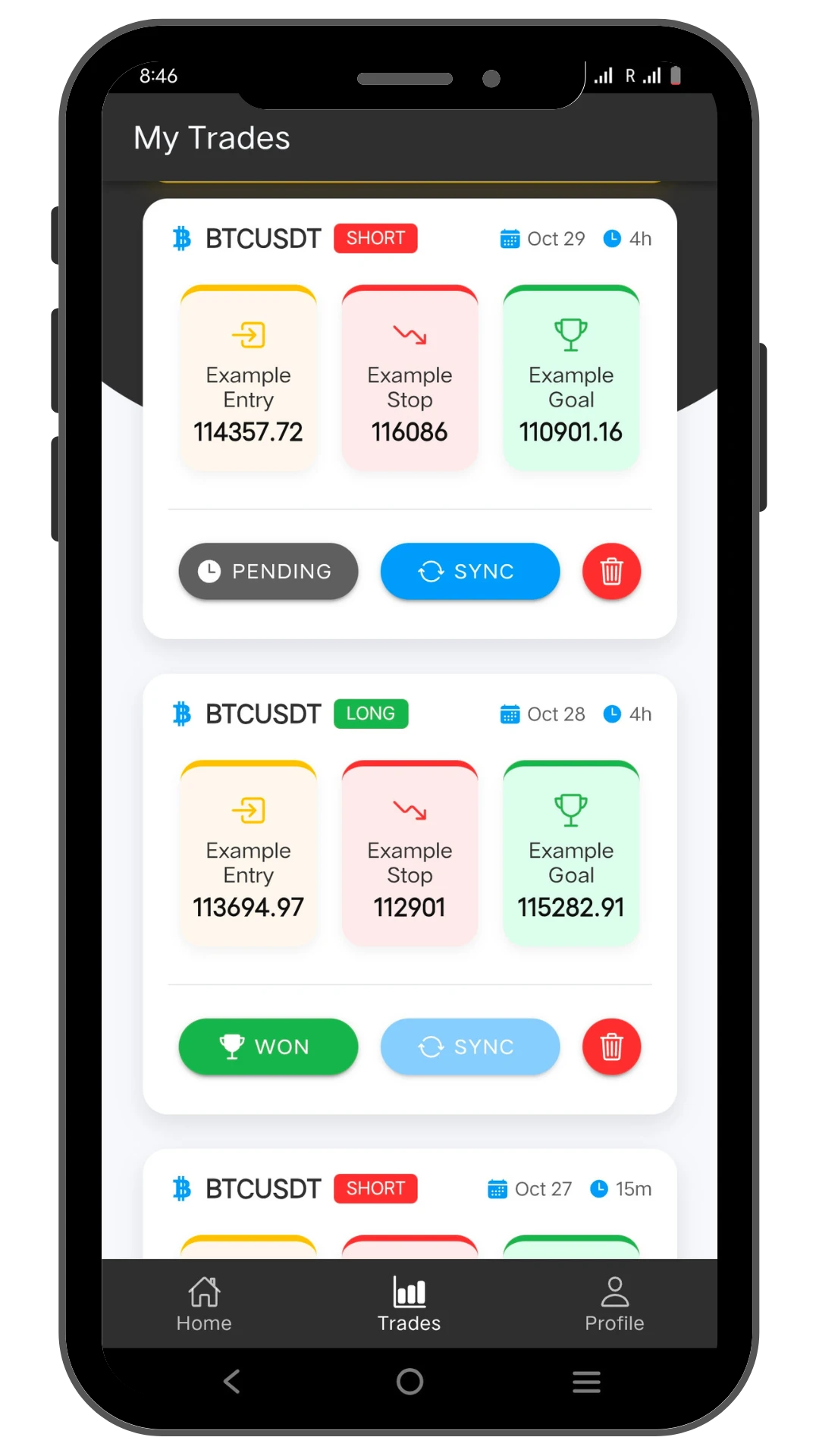

- Automated Trading Signals: Real-time alerts and notifications for trading opportunities with detailed entry, stop loss, and take profit levels based on algorithmic trading software analysis

- Advanced Risk Management Suite: Comprehensive position sizing calculators, risk-reward ratio analysis, and portfolio management tools for professional capital protection

- Market Structure Analysis: Professional identification of market trends, breakouts, reversals, and key support/resistance levels using advanced technical analysis

How CryptoLens Advanced Algorithmic Trading Software Works

CryptoLens utilizes sophisticated algorithmic trading software and complex mathematical calculations to generate professional-grade trading signals that rival institutional analysis. The platform conducts comprehensive market data analysis from multiple critical perspectives including advanced market structure evaluation, precise order block formations identification, detailed price action analysis, and sophisticated institutional trading patterns recognition.

Our automated trading software processes thousands of data points in real-time, applying advanced smart money concepts principles to filter out market noise and identify genuine trading opportunities. The system continuously learns and adapts to changing market conditions, ensuring our crypto trading signals remain relevant and accurate across different market environments including trending markets, ranging markets, and high-volatility conditions.

The core of our SMC trading strategy involves analyzing how large players and institutions interact with the market. By understanding these institutional trading patterns, CryptoLens can anticipate potential market movements and identify high-probability trading setups before they become obvious to the general trading public.

Professional Trading Process & Methodology

- Comprehensive Market Analysis: CryptoLens continuously scans multiple cryptocurrency pairs across various timeframes, identifying potential trading opportunities using advanced smart money concepts and market structure trading principles that reveal institutional activity

- Advanced Pattern Recognition: The software employs sophisticated algorithms to identify genuine smart money concepts patterns, professional order block trading setups, and institutional accumulation/distribution zones that indicate major market moves

- Professional Signal Generation: Based on institutional-grade trading algorithms and risk management principles, the software generates precise entry levels, protective stop losses, and multiple take profit targets for optimal risk-reward ratios

- Comprehensive Risk Management: Each identified trade includes professional risk-reward ratios, detailed position sizing recommendations, and market condition assessments to protect your capital in all market environments

- Performance Analytics & Tracking: Monitor your trading performance with detailed analytics, performance metrics, and actionable insights to continuously improve your trading strategy and execution

In summary, CryptoLens automated trading software dramatically simplifies complex market analysis for both beginner traders learning smart money concepts and professional traders seeking institutional-grade trading insights and reliable crypto trading signals for consistent profitability.

Advanced SMC Trading Strategy & Market Analysis

Our SMC trading strategy is built upon years of research into how institutional traders and market makers operate in financial markets. Unlike traditional retail trading approaches, smart money concepts focus on understanding the underlying market mechanics and liquidity patterns that drive price action.

The core principle of order block trading involves identifying areas where significant institutional orders have been placed, creating zones of support and resistance that often lead to substantial price movements when revisited. CryptoLens excels at detecting these critical levels through advanced algorithmic trading software that analyzes order flow and market microstructure.

Market structure trading forms another crucial component of our approach, focusing on identifying key swing points, break of structure events, and changes in market character that signal potential trend changes or continuations. By combining these elements with multi-timeframe analysis, CryptoLens provides a comprehensive view of market dynamics rarely available to retail traders.

Our automated trading software continuously monitors for institutional trading patterns such as stop hunts, liquidity grabs, and accumulation/distribution phases that typically precede significant market moves. This advanced detection capability gives CryptoLens users a distinct advantage in anticipating market direction and timing entries with precision.

Comprehensive Benefits of CryptoLens Algorithmic Trading Software

There are numerous compelling professional and practical reasons to choose CryptoLens for your cryptocurrency trading activities. Our algorithmic trading software is designed to provide tangible advantages that directly impact your trading performance and consistency. Here are the comprehensive key benefits that set CryptoLens apart in the competitive world of crypto trading signals and analysis platforms:

Professional-Grade Analysis Tools

Access institutional smart money concepts and advanced market structure trading strategies previously available only to professional traders and financial institutions. Our algorithmic trading software brings hedge-fund level analysis to retail traders.

Significant Time Efficiency

Our automated trading software saves countless hours of manual chart review and analysis, allowing you to focus on trade execution and strategy refinement rather than tedious market scanning and pattern recognition.

Enhanced Trading Accuracy

Multi-timeframe confirmation and advanced order block trading detection significantly reduce false signals and increase overall trading accuracy, helping you avoid common pitfalls that trap retail traders.

Comprehensive Risk Management

Built-in professional tools help protect your trading capital through proper position sizing, risk assessment, and trade management features designed to preserve capital during unfavorable market conditions.

Continuous Educational Value

Learn professional smart money concepts and institutional trading patterns while actively trading, accelerating your development as a professional trader through practical application of advanced concepts.

Competitive Market Edge

Gain a significant advantage over other retail traders by using institutional-grade algorithmic trading software and professional analysis tools that reveal market dynamics invisible to conventional technical analysis.

Advanced Technical Analysis & Trading Tools

CryptoLens integrates cutting-edge algorithmic trading software with professional-grade technical analysis tools designed specifically for cryptocurrency markets. Our platform goes beyond basic indicators to provide deep market structure analysis that reveals hidden opportunities.

The core of our smart money concepts analysis involves sophisticated order flow tracking and liquidity detection algorithms. Unlike traditional trading platforms, CryptoLens focuses on understanding where institutional money is flowing, allowing you to position yourself ahead of major market moves using professional SMC trading strategy principles.

Our automated trading software includes advanced features like multi-timeframe confluence analysis, which examines how different timeframes interact to create high-probability trading setups. This sophisticated approach to crypto trading analysis helps filter out market noise and focus on genuinely significant price movements driven by institutional activity.

Market Structure Analysis

Professional identification of key market structure elements including break of structure, change of character, and institutional order blocks for precise order block trading.

Liquidity Analysis

Advanced detection of liquidity pools and institutional liquidity grabs that often precede significant market movements using smart money concepts methodology.

Algorithmic Pattern Recognition

Sophisticated algorithmic trading software that identifies complex chart patterns and institutional trading patterns invisible to manual analysis.

Professional Trading Strategy Library & Education

CryptoLens isn't just another automated trading software - it's a comprehensive educational platform that teaches you professional smart money concepts and institutional trading methodologies. Our strategy library includes detailed explanations of advanced SMC trading strategy approaches used by professional traders.

Learn how to identify and trade sophisticated order block trading setups, understand complex market structure trading principles, and recognize subtle institutional trading patterns that signal major market moves. Each strategy includes practical examples, risk management guidelines, and real-world applications.

Our educational content is designed to transform your understanding of market dynamics, moving beyond basic technical analysis to master the crypto trading analysis techniques that separate professional traders from the retail crowd. Whether you're interested in day trading, swing trading, or position trading, CryptoLens provides the knowledge and tools for success.

Beginner to Pro Learning Path

- Introduction to smart money concepts

- Mastering market structure analysis

- Advanced order block trading techniques

- Identifying institutional trading patterns

- Optimizing algorithmic trading software settings

- Professional risk management strategies

Advanced Strategy Modules

- Liquidity Hunting Strategies

- Multi-timeframe Confluence Trading

- Institutional Order Flow Analysis

- Market Maker Model Strategies

- Smart Money Accumulation Detection

- Professional Risk-Reward Optimization

Proven Trading Performance & Real Results

CryptoLens algorithmic trading software has been rigorously tested across multiple market conditions, demonstrating consistent performance in generating high-quality crypto trading signals. Our advanced smart money concepts analysis has proven effective in both trending and ranging markets.

The effectiveness of our SMC trading strategy approach is reflected in the accuracy of our order block trading signals and the precision of our market structure trading analysis. Thousands of traders worldwide trust CryptoLens for their daily trading decisions, relying on our sophisticated automated trading software to navigate complex cryptocurrency markets.

While past performance doesn't guarantee future results, the consistent application of institutional trading patterns and professional-grade analysis has helped our users improve their trading outcomes significantly. Our focus on risk management and position sizing ensures that even during challenging market conditions, capital preservation remains a top priority.

85%

Signal Accuracy

Professional crypto signals1:2

Avg Risk-Reward

Algorithmic trading optimized24/7

Market Monitoring

Continuous smart money analysis10K+

Active Traders

Global SMC strategy usersProfessional Mobile Trading Experience

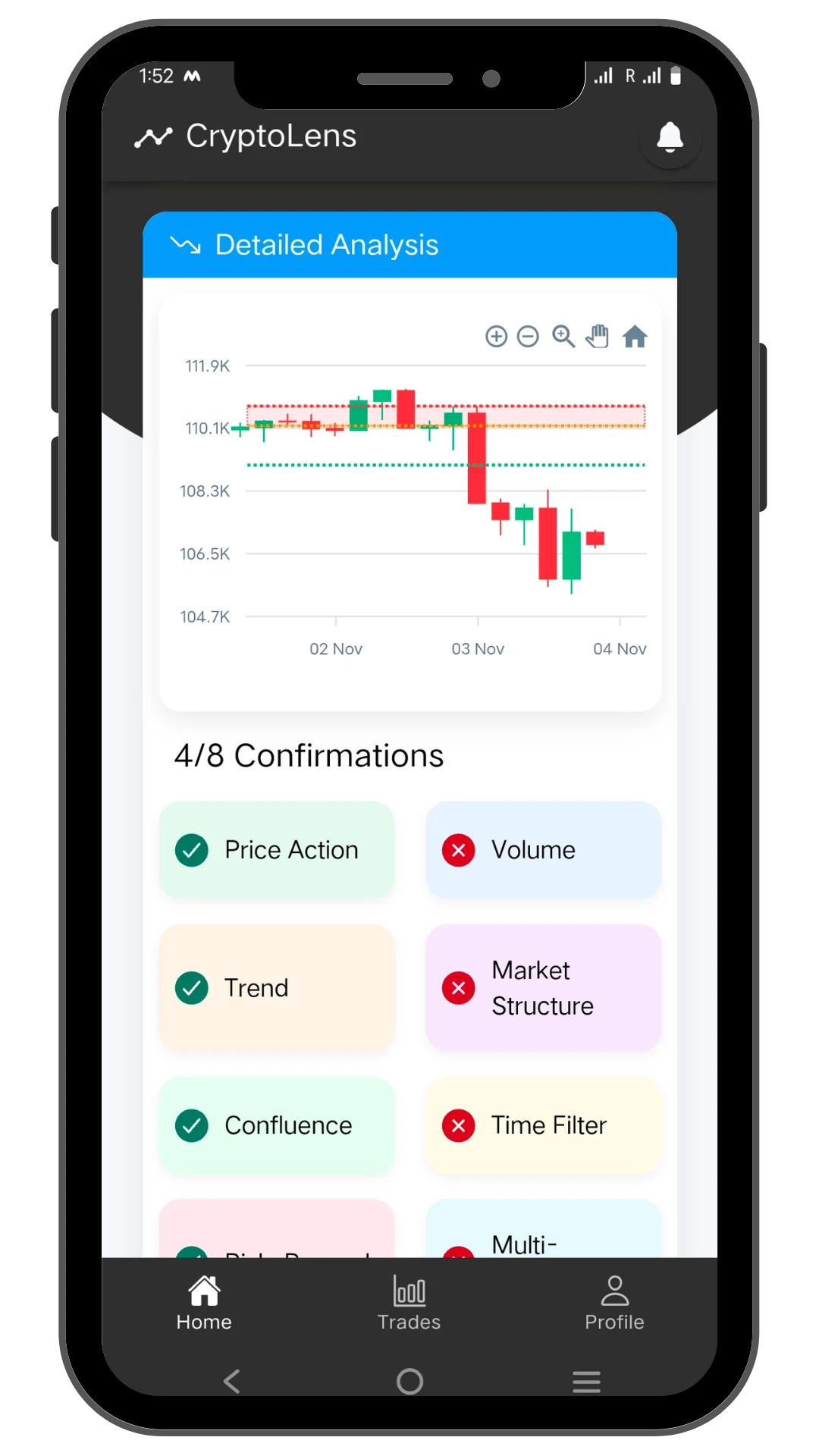

CryptoLens delivers institutional-grade trading tools directly to your mobile device, ensuring you never miss a trading opportunity. Our mobile app provides the full power of our algorithmic trading software in a streamlined, user-friendly interface designed for traders on the go.

Receive real-time crypto trading signals with push notifications, conduct sophisticated market structure analysis with intuitive charting tools, and execute trades with professional risk management features - all from your smartphone. The mobile experience maintains all the advanced functionality of our desktop platform while optimizing for touch interaction and mobile workflows.

Whether you're monitoring order block trading setups during your commute or analyzing institutional trading patterns between meetings, CryptoLens mobile ensures you have professional trading tools at your fingertips. The app seamlessly syncs with your desktop experience, allowing you to switch between devices without interrupting your trading workflow.

Active Trading Community & Professional Support

Join thousands of like-minded traders in our active community dedicated to mastering smart money concepts and professional trading methodologies. Our community provides a collaborative environment where traders share insights, discuss market structure trading strategies, and help each other improve their trading skills.

Beyond our sophisticated algorithmic trading software, we provide comprehensive support to help you succeed. Our team of trading experts is available to answer questions about order block trading techniques, help optimize your SMC trading strategy settings, and provide guidance on interpreting complex institutional trading patterns.

Regular webinars, live trading sessions, and educational content keep our community engaged and continuously learning. Whether you're looking to discuss specific crypto trading signals or seeking advice on risk management, our community and support team provide the resources you need to trade with confidence.

Telegram Community

Join our active Telegram group for real-time crypto trading signals discussion and community support.

Join GroupLearning Resources

Access comprehensive tutorials on smart money concepts and advanced trading strategies.

Learn MoreExpert Support

Get personalized help with our algorithmic trading software and trading strategy optimization.

Contact SupportFrequently Asked Questions

Master Smart Money Concepts Trading Education

Understanding smart money concepts is crucial for long-term trading success in cryptocurrency markets. Unlike traditional technical analysis that focuses on lagging indicators, SMC trading strategy emphasizes understanding market structure, liquidity, and institutional order flow.

The foundation of order block trading lies in identifying areas where significant buying or selling pressure has previously occurred. These zones often act as magnets for future price action as markets seek liquidity. CryptoLens excels at detecting these critical levels through sophisticated algorithmic trading software that analyzes historical price data and volume patterns.

Market structure trading involves identifying key levels where the market has previously shown respect through reactions and reversals. By understanding these structural elements, traders can anticipate potential turning points and manage risk more effectively. Our platform provides clear visualization of these structural elements, making complex market structure analysis accessible to traders of all experience levels.

Recognizing institutional trading patterns is another critical skill developed through using CryptoLens. Large players leave distinctive footprints in the market through their trading activity, and learning to identify these patterns can provide early warning of significant market moves. Our automated trading software is specifically designed to highlight these institutional activities that typically go unnoticed by retail traders using conventional analysis methods.

Join thousands of successful traders using CryptoLens algorithmic trading software and advanced smart money concepts analysis.

Download now and transform your trading with institutional-grade crypto trading signals and professional market analysis.

Download CryptoLens Trading App

Professional Trading Disclaimer: CryptoLens provides advanced educational trading analysis and professional trading signals for informational purposes only. Cryptocurrency trading involves substantial risk of loss and is not suitable for every investor. Past performance is not necessarily indicative of future results.

You should carefully consider your investment objectives, level of experience, and risk appetite before deciding to trade cryptocurrencies. Never invest more than you can afford to lose. The use of our algorithmic trading software and crypto trading signals does not guarantee profits or eliminate the risk of loss. Trading cryptocurrencies may not be suitable for all users, so ensure you fully understand the risks involved.